Some Of Pacific Prime

Some Of Pacific Prime

Blog Article

A Biased View of Pacific Prime

Table of ContentsPacific Prime for DummiesExcitement About Pacific PrimeAbout Pacific PrimeThe 10-Second Trick For Pacific PrimeThe Of Pacific Prime

Insurance policy is a contract, represented by a policy, in which a policyholder receives monetary security or reimbursement versus losses from an insurance provider. The firm swimming pools customers' risks to pay a lot more cost effective for the guaranteed. Many people have some insurance policy: for their auto, their residence, their health care, or their life.Insurance policy additionally helps cover prices connected with liability (lawful obligation) for damage or injury triggered to a 3rd party. Insurance is an agreement (plan) in which an insurance firm compensates one more versus losses from certain backups or risks. There are lots of types of insurance policies. Life, health, homeowners, and vehicle are among the most typical kinds of insurance coverage.

Investopedia/ Daniel Fishel Numerous insurance coverage plan types are available, and practically any kind of specific or organization can discover an insurance firm going to guarantee themfor a price. Typical personal insurance plan kinds are auto, wellness, property owners, and life insurance policy. The majority of individuals in the USA have at least one of these types of insurance coverage, and cars and truck insurance coverage is required by state legislation.

Some Known Details About Pacific Prime

Locating the rate that is right for you calls for some research. The plan limit is the maximum amount an insurance firm will certainly pay for a covered loss under a plan. Maximums might be established per duration (e.g., yearly or plan term), per loss or injury, or over the life of the plan, additionally called the life time optimum.

There are many different kinds of insurance coverage. Health insurance coverage helps covers regular and emergency medical care costs, usually with the option to include vision and oral solutions independently.

Numerous preventive solutions might be covered for free prior to these are fulfilled. Health insurance coverage might be acquired from an insurance business, an insurance policy representative, the federal Health and wellness Insurance coverage Market, provided by a company, or federal Medicare and Medicaid protection.

Not known Facts About Pacific Prime

Rather than paying out of pocket for automobile accidents and damages, individuals pay annual premiums to a vehicle insurance provider. The firm after that pays all or most of the protected expenses connected with a vehicle accident or other vehicle damage. If you have actually a leased vehicle or obtained money to purchase a cars and truck, your lender or renting dealership will likely require you to carry automobile insurance policy.

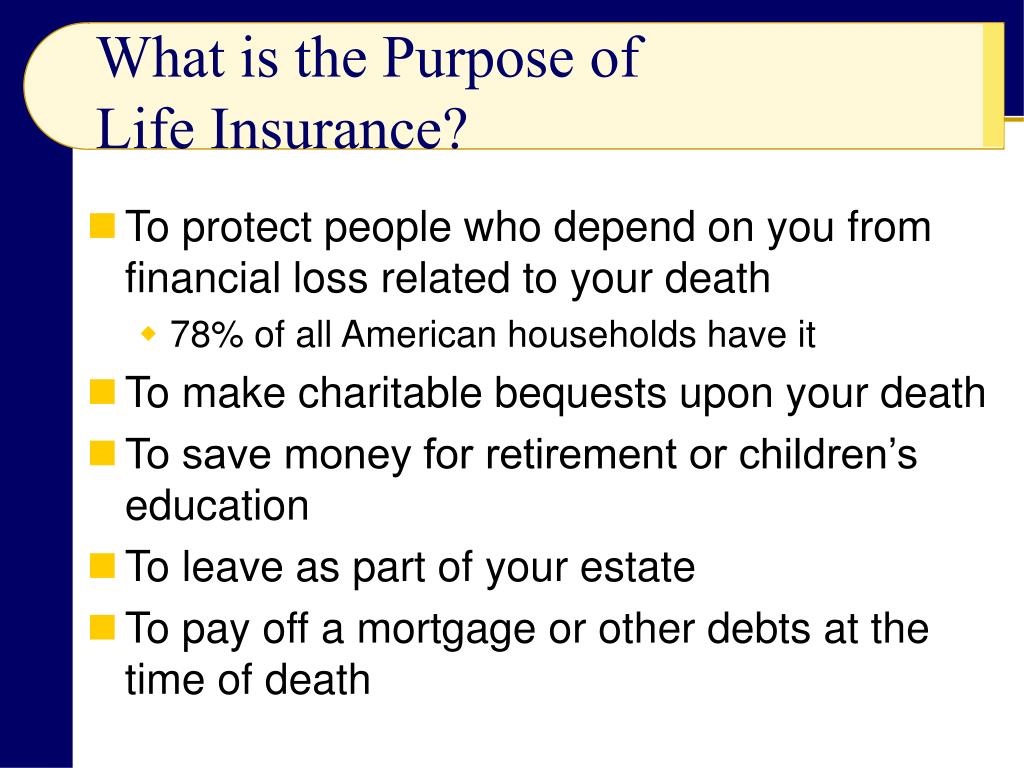

A life insurance coverage policy guarantees that the insurer pays a browse around this site sum of money to your beneficiaries (such as a partner or youngsters) if you die. There are 2 primary types of life insurance.

Insurance is a way to manage your monetary threats. When you buy insurance policy, you acquire protection against unanticipated financial losses. The insurance provider pays you or a person you select if something negative occurs. If you have no insurance coverage and a crash takes place, you might be in charge of all related costs.

Excitement About Pacific Prime

Although there are numerous insurance plan types, several of one of the most common are life, health, homeowners, and vehicle. The right type of insurance policy for you will depend on your objectives and monetary scenario.

Have you ever before had a minute while looking at your insurance policy or purchasing for insurance when you've thought, "What is insurance policy? Insurance coverage can be a strange and puzzling thing. How does insurance policy work?

Nobody wants something bad to happen to them. Experiencing a loss without insurance coverage can put you in a difficult economic circumstance. Insurance coverage is an important economic tool. It can assist you live life with less fears recognizing you'll get economic aid after a catastrophe or mishap, aiding you recuperate much faster.

The 9-Second Trick For Pacific Prime

And in some cases, like automobile insurance coverage and employees' compensation, you may be needed by legislation to have insurance coverage in order to shield others - expat insurance. Learn more about ourInsurance alternatives Insurance coverage is basically a gigantic wet day fund shared by lots of individuals (called policyholders) and taken care of by an insurance coverage copyright. The insurance provider makes use of cash collected (called premium) from its insurance policy holders and various other financial investments to pay for its operations and to accomplish its promise to insurance policy holders when they sue

Report this page